Minimum investment is €100,000 per investor.

Quarterly payouts.

Planned exit in 2030.

Favorte REIF usaldusfond (reg. 16581683) specializes in income-generating stock-office assets, targeting stable quarterly distributions for its investors.

The current value of the fund’s investments is over 39 million euros, comprising eight stock-office buildings in Tallinn and the surrounding area. The total leasable area of the buildings in the portfolio is 34,790 m2. Since inception, the fund has maintained an average occupancy of approximately 97%, outperforming the market average.

The objective for 2026 is to raise €10 million in additional equity to acquire stabilized, fully leased stock-office assets generating immediate positive cash flow.

Minimum investment is €100,000 per investor.

Historical internal rate of return (IRR):

2023: 7,8%

2024: 9,5%

2025: TBA

2026: Request more information

Quarterly payouts.

Planned exit in 2030.

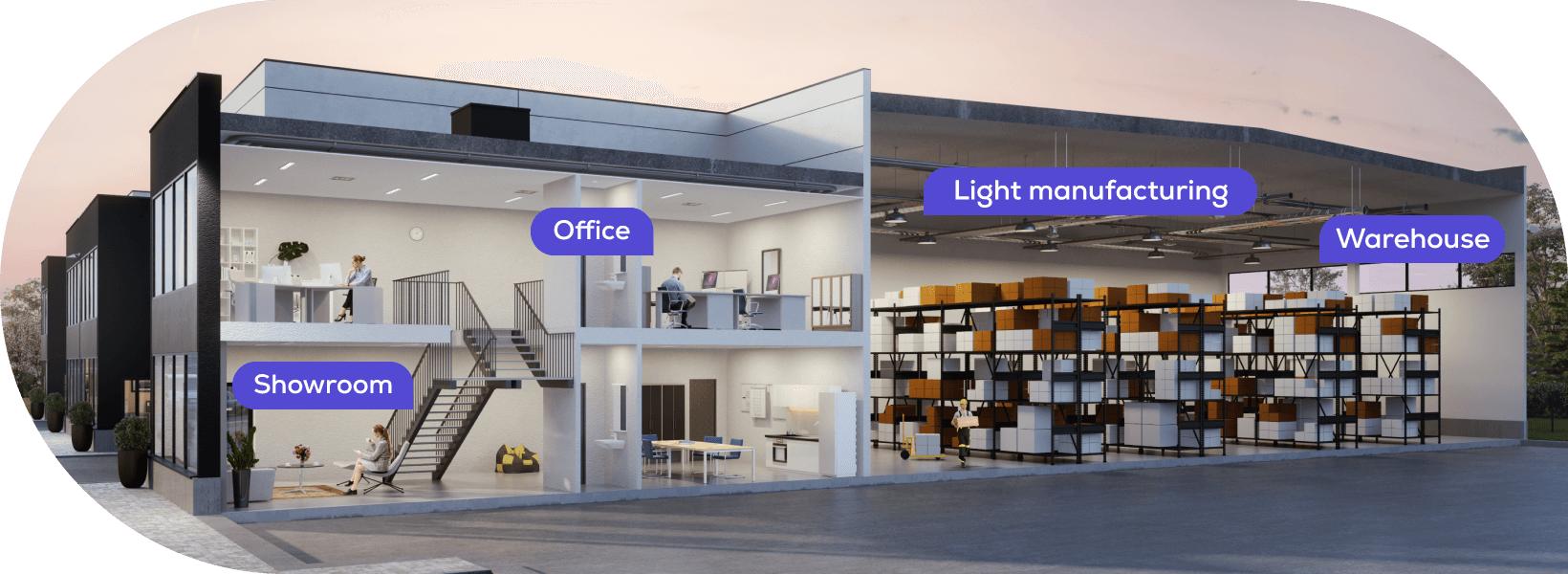

Over the years, we have acknowledged a surge in demand from small and medium sized enterprises that need new and flexible commercial spaces to accommodate and support their dynamically developing operations. Stock-offices combine warehouse, office and showroom functions, providing the optimal solution for the requirements of these fast-growing businesses.

The fund is headed by business partners Hendri Hinno and Rainer Hinno, who is the owner of the successful real estate development company Favorte, which has been operating in the Baltic and Estonian markets for almost 30 years. Favorte is currently one of the largest developers of stock-offices in Estonia.

Favorte REIF was established in 2022. The Fund Manager is Favorte Fondijuhtimise OÜ, a private limited company registered with the Financial Supervision and Resolution Authority. The auditor of the fund is KPMG.

The small fund manager acts on the basis of registration. It does not hold the activity licence of a fund manager or small fund manager and is not supervised by the Financial Supervision and Resolution Authority.

Stock-office commercial buildings combine warehouse, production, office and showroom spaces.

This “all in one” solution allows both medium-sized and fast-growing small businesses to keep their teams together, thereby increasing the efficiency and flexibility of their business processes. In a rapidly changing business environment, bringing an agile team under one roof creates synergy that provides a significant advantage over inflexible, cumbersome and often fragmented processes and logistics.

Multifunctional stock-office buildings can accommodate warehouse and production units as well as office space in a single leased area. The buildings have well-designed office areas for management functions and showrooms for receiving customers and business partners. Using a stock office saves time and improves communication, also cutting other costs for the tenants.

In addition, as a result of the Covid-19 pandemic, many small and medium-sized enterprises have found that keeping buffer storage close by is beneficial to the success of their businesses. Since it is often too risky to depend on the reliability of long supply chains that have been battered by multiple crises, the immediate availability of goods and their rapid delivery is an important competitive advantage in today’s market.

Favorte REIF is designed for investors who appreciate decent returns and prudent risk management. It is for persons who want their investment to be visible and transparently managed on a daily basis.

Equity always seeks value creation. The safest investment is, of course, a term deposit with a bank, but its return remains below even inflation. Stock exchanges, commodity markets, not to mention cryptocurrencies, are volatile and high-risk. Various real estate funds balance this range, but are typically associated with an unstable residential asset class, where the emphasis is on growth in asset value rather than real added value in the form of returns.

However, Favorte REIF is able to generate an average annual IRR of up to 14% over the investment period, even when markets are not booming.

Founded by Rainer Hinno, Favorte has built up a group of companies over a period of more than 30 years that has developed over two hundred thousand square meters of real estate, including a couple of dozen commercial properties. This is how the fund’s investment portfolio was created, designed to withstand any economic situation and to perform even in more difficult times.

And so Favorte REIF was born – backed by 13 million euros of equity from the Hinno family. Including bank financing, the fund has a total volume of nearly 40 million euros. The fund is managed by Hendri Hinno, who acts on the principles and values of the real estate group founded in 1993.

Favorte REIF is not looking for the “next big idea” on the market.

The fund’s portfolio includes the most practical asset class, where demand is driven by entrepreneurship, not emotion or gut feeling. It is in this sense that the fund is a safe haven for those who want to invest their money in lower-risk assets with credible returns – it is stable, understandable and sufficiently conservative, without complex financial instruments or risk formulas.

Favorte REIF was not born overnight. It is the legacy and a continuation of the life’s work of one man, his family and a team that has developed and grown over the years.

It is not an illusory engineering exercise designed to collect external money from the market.

The fund’s current assets have largely grown out of Favorte’s own developments, which means that the portfolio is built on its own risk-taking, rather than raising money from anonymous investors – the fund is not asking the market for anything the owner doesn’t do himself.

For the investor, this means that the fund’s management team does not make decisions to demonstrate high returns in the short term, but to preserve the value of the assets and actually increase capital.

The fund offers three core values for the investors: